Individual customer protection. Secure, convenient, and cost-effective digital service channels for private users

Posted on 29.06.2020 at 16:23

Securing individual customers finances in remote banking services (RBS) remains a key problem of modern banking. The overall volume and quantity of attempts at fraudulent transactions with individual customer accounts increases every year. On the other hand, simplifying a user’s experience in online and mobile banking is now a necessary prerequisite for customer loyalty.

Mobile transaction authentication signature (mTAS) technology combines the need for private user protection, while enhancing user experience.

Security problems of individual customers:

- A spike in bank fraud using social engineering and malware.

- Transaction authorization technologies using SMS and push codes are outdated and not secure.

- In the event of an incident, it is difficult to defend a bank’s interests in court.

Business objectives

A top-tier digital banking service cannot afford to compromise neither on security nor on user experience. Hence, banks aim to effectively combat social engineering and cyberattacks, while also reducing user transaction authorization paths in online and mobile banking. In this context, traditional security tools—based on SMS and push codes—have ceased to suit banking requirements. The best alternative solution is a mobile transaction authentication signature: customers can authorize transactions and documents in any service channels with a single tap on a smartphone screen.

The key requirement for such a digital solution is assuring authorship and integrity of signed documents. Moreover, it should have advanced conflict analysis capabilities to eliminate financial risks in case a customer disputes a transaction.

A solution that meets all these requirements is PayConfirm, a mobile transaction authentication signature platform developed by Singaporean company—Airome Technologies.

Solution description

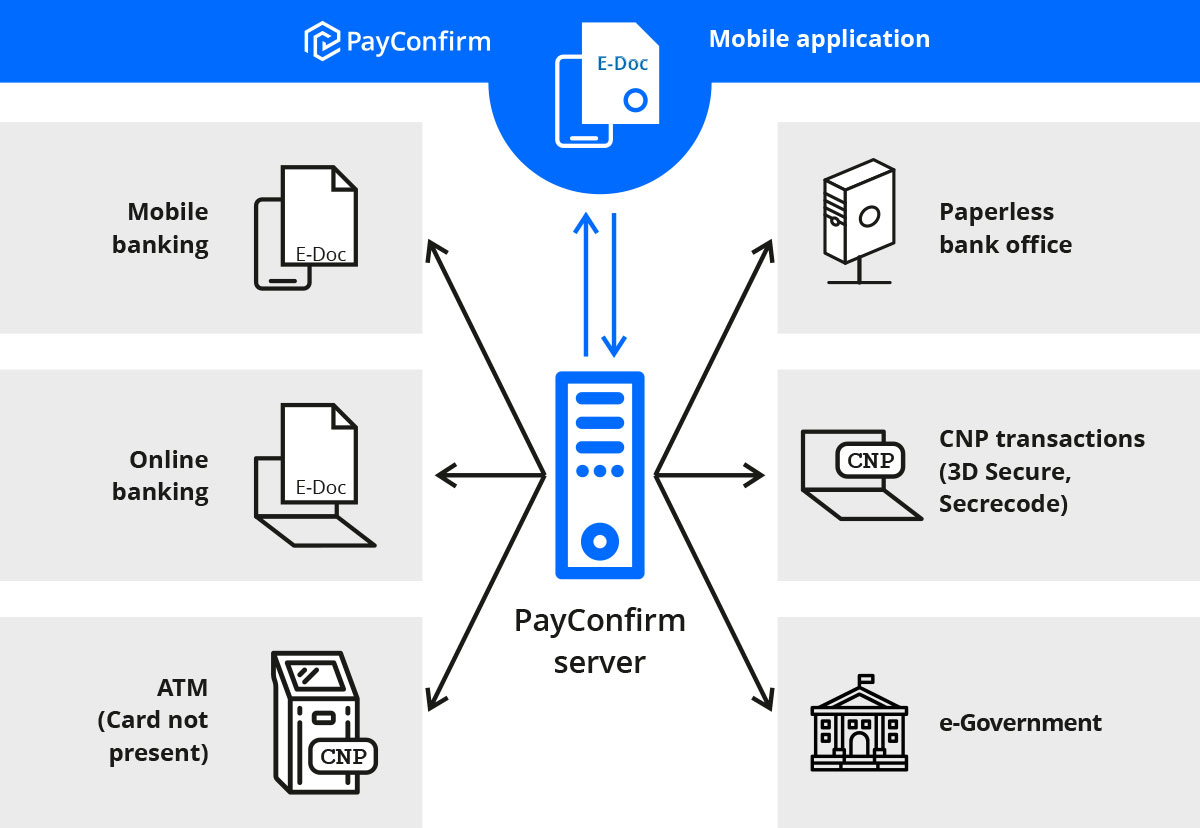

PayConfirm is a software platform that performs mobile transaction authentication signature (mTAS) to authenticate or confirm any type of operations, including transactions or e-documents, on a mobile device.

PayConfirm allows to effectively combat social engineering. A confirmation is generated based on the transaction details or the document’s content. Customers do not receive codes from their bank—they have no information to disclose to attackers.

PayConfirm is embedded in a bank’s mobile application or operates as a stand-alone application on a user’s smartphone. Regardless of the use-case, the customer can verify the correctness of transaction details or document content and then generate a signature by simply tapping the Confirm button.

Implementation technologies

The PayConfirm platform includes several functional modules: mobile transaction authentification signature, customer transaction notifications, conflict analysis, customer identification and authentication, and early fraud prevention. The implementation scope is based on the needs of the specific bank and its customers.

Airome Technologies is willing to share its success stories; provide a full set of project and technical documentation; help you formalize your business requirements; help choose the best option for embedding, deploying, and operating the PayConfirm platform.

Results

Signing transactions and documents on a smartphone using the PayConfirm platform:

- provides the highest possible protection for private user transactions;

- enhances user experience and speeds up customer service;

- helps a bank achieve higher ratings concerning the quality of digital banking services for individuals.