Paperless bank office. A high-tech, legally effective, and economical way to interact with customers

Posted on 29.06.2020 at 16:04

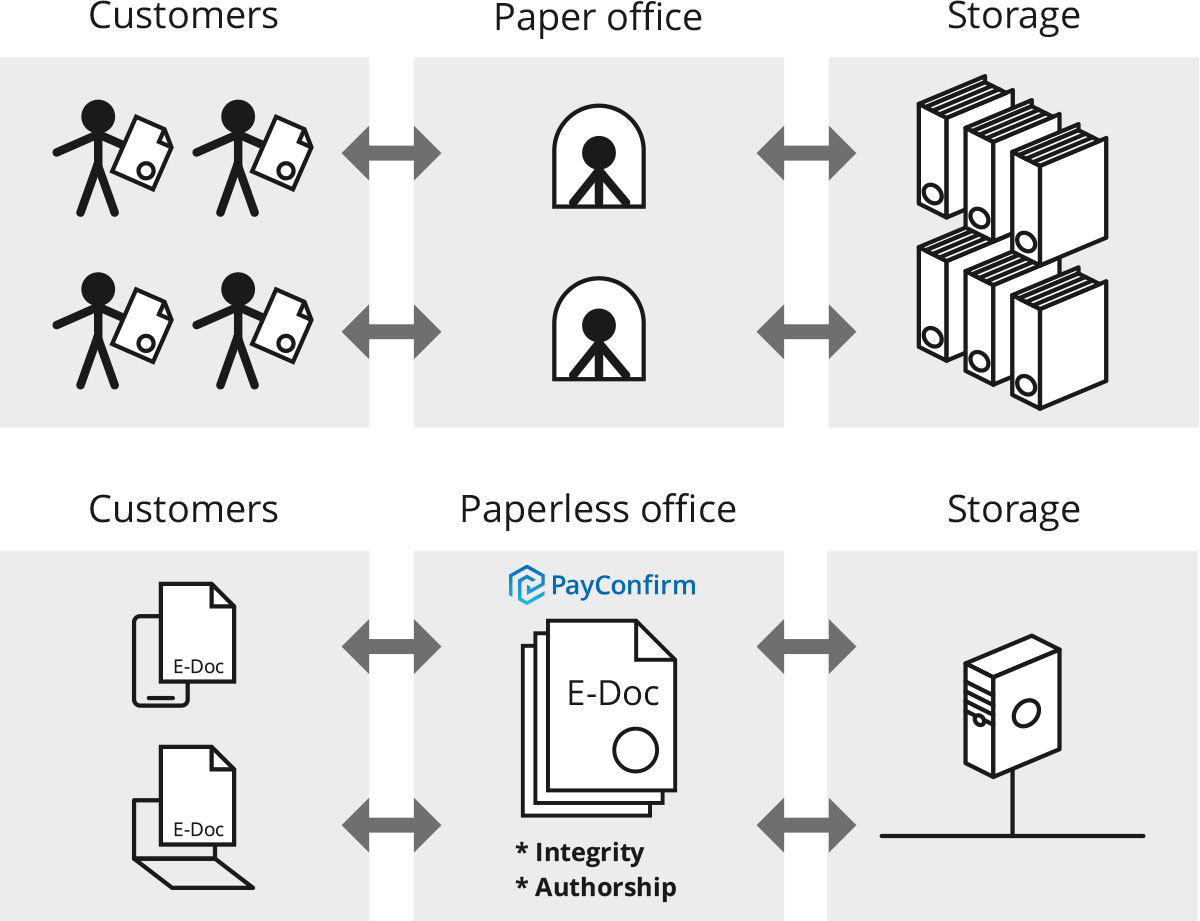

Most banks sign a lot of paper documents with their customers: agreements to open current accounts, issue loans, place deposits, investments, and other services. All of this leads to significant costs associated with printing, logistics, and document storage. It also limits customer service to in-person interactions at a bank’s office.

How can a business reduce costs without sacrificing quality and get additional benefits? A paperless bank office is the answer.

Here are the problems of a “paper” office:

- Banks need to communicate with a customer in-person to execute any agreement.

- Significant expenses on paper and maintenance of office equipment.

- Risks of document loss in archives.

Business objectives

Expansion of services and growth in the number of customers inevitably challenge banks to reduce the financial and time costs of paperwork, and lower the risk of errors. The most effective solution is the use of digital service channels, execution and digital signing of agreements.

Digital interaction should not only be more convenient and accessible for customers, but also as secure and legally effective as traditional methods. Therefore, banks have to ensure the integrity and authorship of signed digital documents. In addition, the digital signing solution should have extensive capabilities for resolving conflict situations in order to avoid legal risks that may arise if a customer disputes their operation.

PayConfirm, a mobile authentication and digital signature platform developed by Airome (a Singaporean company), meets these requirements.

Solution description

PayConfirm is a digital signing solution “in your smartphone”, which allows customers to authorize their transactions in any digital channels with high security levels and convenience in online and mobile banking, CNP operations, telephone banking, and a paperless office.

A prerequisite for creating a bank’s paperless office is to ensure the legality of transactions, i.e. to control the integrity and authorship of digital documents.

PayConfirm is embedded in the bank’s mobile application and operates on the customer’s smartphone. Alternatively, it can be installed on a clerk’s tablet to be used when the customer visits the bank’s office. Regardless of the device used, the customer can verify the correctness of a digital document and generate a signature.

Implementation technologies

Unlike traditional signing methods, such as SMS and push codes, PayConfirm allows you to reduce legal risks and ensure regulatory compliance.

PayConfirm provides the perfect mechanism for creating a paperless bank office when:

- A bank is transferring customer communications to digital channels, but is still at the stage of choosing the appropriate digital signing technology.

- A bank has already built a paperless office, and is now considering replacing SMS and push notification technologies with something more secure and convenient.

Airome is ready to share its experience of completed projects with banks and provide technology and business consulting.

Results

A paperless bank office is created using the PayConfirm platform that:

- Fully ensures the legality of transactions (compliance with the requirements of government legislation).

- Reduces time and financial costs of interaction with customers, paper and office equipment maintenance.

- Lowers the risk of customer interaction mistakes and the risk of losing documents.

- Improves the customer service quality and efficiency.