Turnkey digital customers. Moving customers from offline to online safely and conveniently

Posted on 12.11.2020 at 14:26

One of the greatest assets of any modern company are their digital customers. They are identified, connected to information systems, and ready to interact via digital channels. The company’s main competitive advantage then becomes onboarding: reliable and secure digital tech for remotely gaining new clients at minimum cost and in the fewest steps possible.

So how do you organize the process of getting online customers? How do you ensure they are identified remotely, set up legally relevant document management, and make further communication safe and convenient?

Challenges in customer onboarding over digital channels:

- Scarce or underdeveloped solutions for remote customer identification.

- Outdated and unsecure authorization technologies that use SMS and push notifications.

- Lack of authorship and integrity control that lets a counterparty dispute the document’s authenticity in court.

BUSINESS OBJECTIVES

To convert an unknown prospect into a user of your digital product without meeting face-to-face, businesses need to deal with a number of technical and legal tasks:

- Identify the customer remotely using biometrics and verified digital copies of their documents that underwent OCR, in strict compliance with Russian legislation.

- Ensure the legal relevance of the communications: develop a contractual structure, provide a digital signature tool that ensures document integrity and authorship, register public keys, or use Public Key Infrastructure and digital certificates.

- Protect the digital interaction from cyber attackers and prevent unauthorized actions on the customer’s behalf.

The PayConfirm platform combines biometric and cryptographic technologies to provide an easy, reliable, and effective procedure for remote customer identification and customer interactions that are both secure and legally relevant.

Airome Technologies, a Singaporean company, addresses these tasks with PayConfirm, a mobile authentication and digital signature platform.

SOLUTION DESCRIPTION

PayConfirm is a software platform that performs mobile transaction authentication signature (mTAS) that lets customers confirm transactions on their smartphone with a high level of security and convenience over any digital channel. These include online and mobile banking, CNP operations, telephone banking, and paperless office.

The PayConfirm platform includes several functional modules: customer identification and authentication, mobile digital signing, customer transaction notifications, conflict handling, and early fraud prevention. The scope of implementing the project depends on the needs of the specific client and their customers.

SOLUTION WORKFLOW

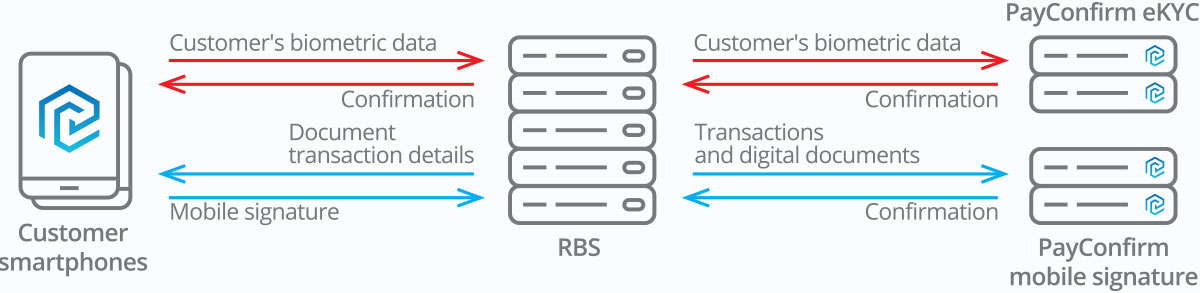

When a new customer connects to a digital channel, they use a convenient mobile app to take a picture of their face (a selfie), capture a dynamic image (liveness), and scan their documents (usually their passport). The platform then verifies the biometric data for correctness and compares it to the passport photo. It also runs the prospect’s information through specialized law enforcement databases.

Once the customer is successfully verified, the system creates a new account, generates and registers digital signature keys, and grants them access to digital services.

The customer signs their transactions and documents with a mobile digital signature right on their smartphone. This mode of operation minimizes information security risks while maintaining the legal relevance of digital interaction by confirming the authorship and integrity of signed documents.

Airome Technologies is willing to share its success stories and provide technical and business consultation.

Results

Customer onboarding with PayConfirm:

- Provides easy and reliable remote identification of new digital customers;

- Prevents fraudsters from acting on the customers’ behalf;

- Provides authorization of the customers’ will and document signing, while ensuring integrity and authorship, meaning there are no legal risks for the bank.