A smartphone as an ATM smartcard. Withdrawing cash from an ATM with your cell phone, rather than a physical card

Posted on 12.11.2020 at 17:29

A modern bank customer prefers to move around the city without a wallet full of cash and plastic. Everything they need is on their smartphone: NFC for payments, public transit tickets, loyalty cards, and so on. However, sometimes there’s no escaping it, and they need cold hard cash. Making sure they can withdraw from an ATM without having to insert a physical card will definitely boost the loyalty of your active customer base.

How do you let your clients withdraw cash with their smartphone without upgrading the whole ATM fleet with expensive NFC readers? How do you raise the level of ATM security and lower the number of false customer card blocks? The answer to these questions is a mobile digital signature.

Problems of traditional ATM transactions:

- You can’t withdraw cash from previous generation ATMs without a physical card.

- Risk of fraud is ever-present in ATM card transactions.

- Upgrading an ATM fleet with embedded NFC readers is a significant investment.

BUSINESS OBJECTIVES

If you want to boost customer loyalty and transactional activity, you need to let them use their phones to take out small amounts of cash from ATMs. Cashless payments and transfers alone are not enough. Another pressing issue is preventing fraudulent ATM transactions and false card blocks by anti-fraud systems. A smartphone could serve this purpose by acting as a second factor to authorize suspicious transactions.

This has led to banks looking to implement convenient and secure technologies to provide their customers access to their accounts and ATM services..

Using a mobile digital signature to confirm ATM transactions addresses both business objectives. On the one hand, it grants the customer access to their account and lets them confirm transactions without using their card. On the other, it strongly improves the level of card transaction security.

Airome Technologies, a Singapore-based company, offers a solution to these problems: PayConfirm, a mobile authentication and digital signature platform.

SOLUTION DESCRIPTION

PayConfirm is a digital signature solution that lets customers confirm transactions on their smartphones with a high level of security and convenience over any digital channel. These include online and mobile banking, CNP operations, telephone banking, and paperless office.

PayConfirm is embedded in a bank’s mobile application. Regardless of which device the transaction starts on, the customer can verify its correctness and generate a digital signature.

SOLUTION WORKFLOW

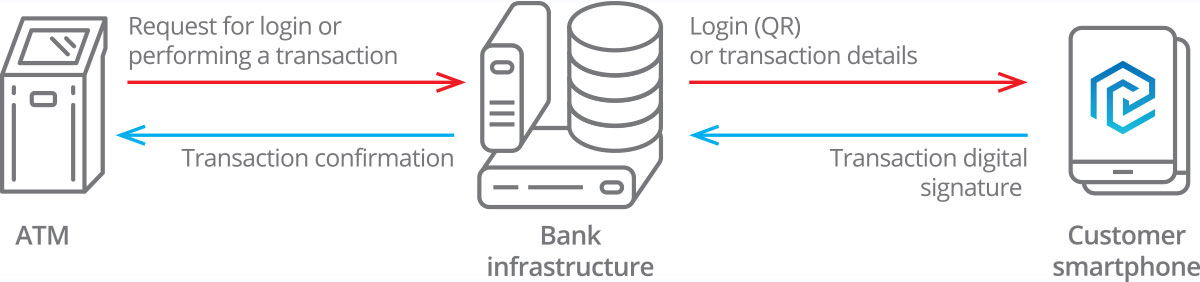

To start working with an ATM without a physical card, the customer needs to open their mobile banking app and scan a QR code with login details on the ATM screen. Once the details are checked, the customer confirms the login on their mobile app and gets access to ATM services.

Availability use case

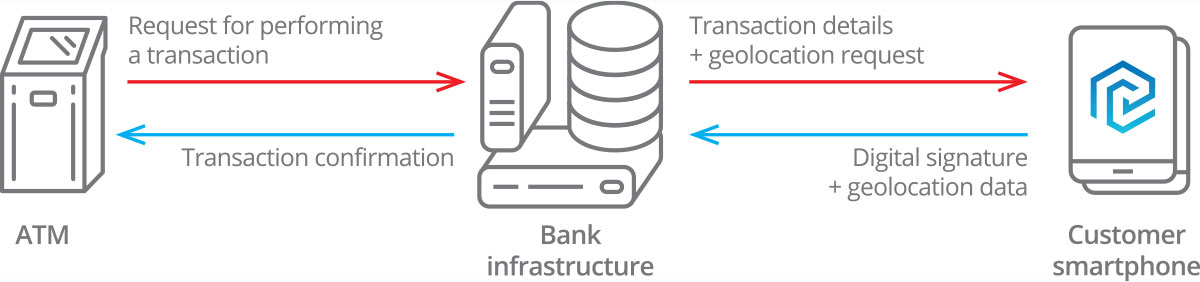

When the customer creates a transaction on the ATM, a request is sent to their mobile banking app to confirm the transaction and current geolocation.

The customer checks the transaction and signs it with their mobile digital signature. As soon as the locations of the ATM and the smartphone match, the transaction goes through.

Security use case

Airome Technologies is willing to share its success stories, and consult banks on the technical and business aspects.

Results

Confirming ATM transactions with PayConfirm:

- Let’s customers withdraw cash from ATMs without physical cards;

- Adds another layer of protection against fraud, minimizes the risk of unauthorized withdrawals and denials of service at the ATMs;

- Lowers the costs for upgrading an ATM fleet — no additional hardware capabilities are required; all you need is a software upgrade;

- Contributes to an increase in the number of mobile banking usersare no legal risks for the bank.