Legal entity customer protection. Secure and convenient digital service channels for legal entities

Posted on 30.06.2020 at 09:14

Securing remote banking services (RBS) remains a key challenge for the banking industry. The overall volume and quantity of attempts at fraudulent transactions with legal entity accounts increases every year. On the other hand, simplifying a user’s experience through desktop and mobile banking is a necessary prerequisite for customer loyalty.

How do you secure accounts of legal entities and enhance their user experience at the same time? The answer—Mobile Transaction Authentication Signature technology.

Digital channel security problems for legal entity customers:

- High cyber-fraud activity.

- Transaction authorization technologies using SMS and push codes are outdated and not secure.

- In the event of an incident, it is difficult to defend a bank’s interests in court.

Business objectives

To survive in a competitive banking market, it is absolutely necessary to offer a functional, convenient, and secure digital service for legal entities. Therefore, a high priority objective for banks is to replace outdated transaction authorization tools—based on SMS and push codes—with seamlessly integrated digital signature technologies in a mobile banking application.

Authorizing the will of legal entity customers should be convenient, secure, and legally effective. Hence, a key requirement from banks and regulators is to assure authorship and integrity of signed digital documents. Moreover, a mobile transaction authentication signature solution should have advanced conflict analysis capabilities to eliminate financial risks in case a customer disputes a transaction.

A solution that meets all these requirements is PayConfirm, a mobile transaction authentication signature platform developed by Singapore company—Airome Technologies.

Solution description

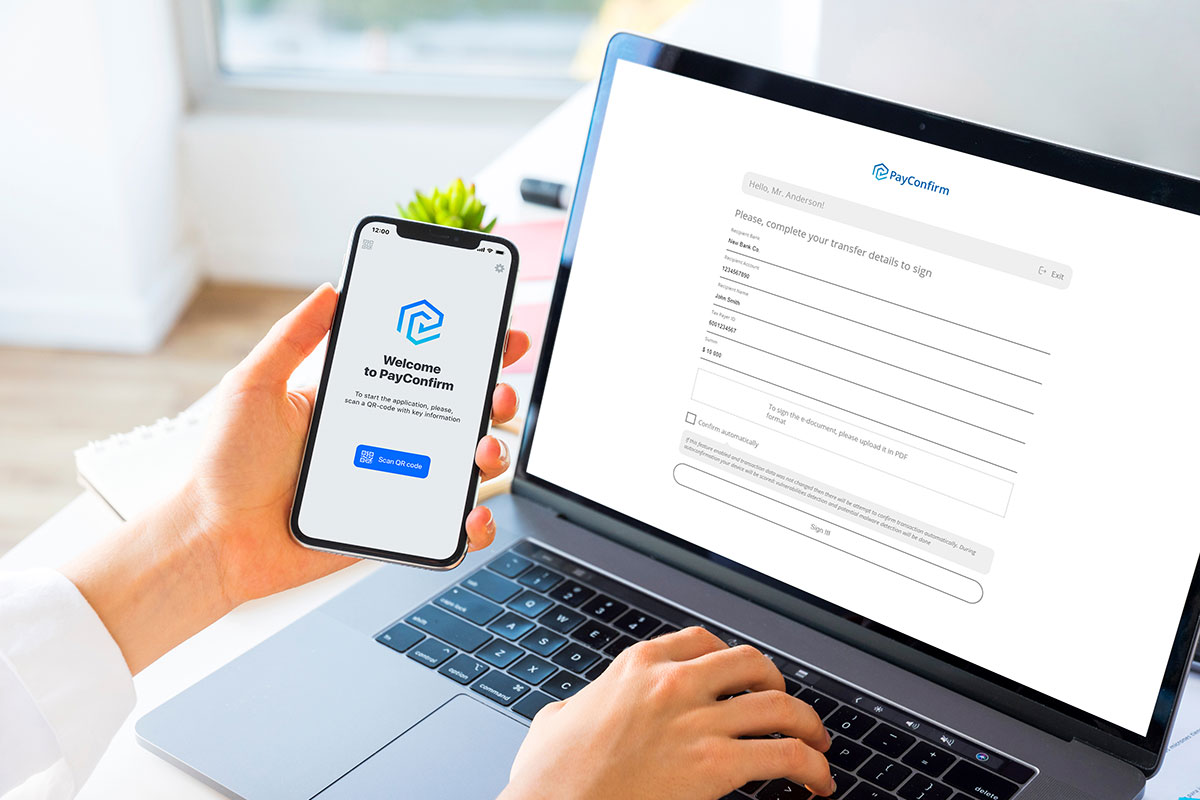

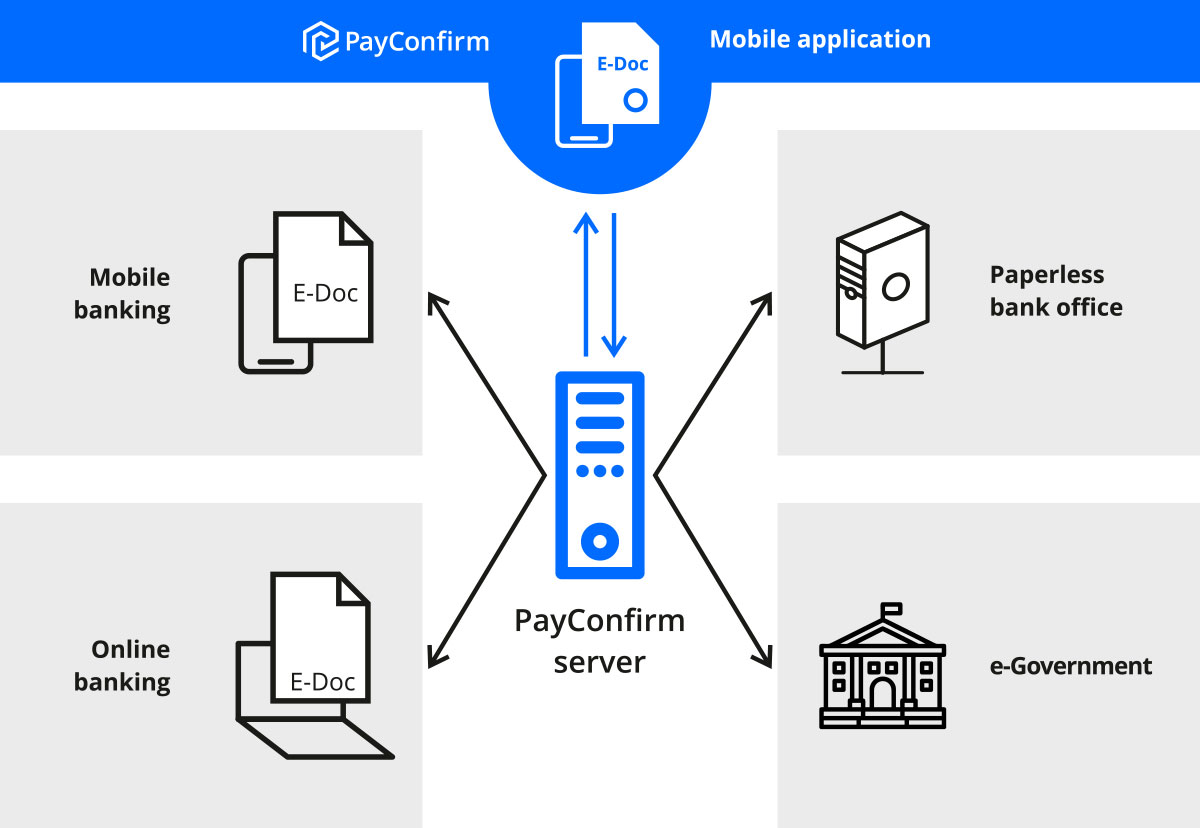

PayConfirm is a software platform that performs mobile transaction authentication signature (mTAS) to authenticate or confirm any type of operations, including transactions or e-documents, on a mobile device.

PayConfirms’ main advantage—compared to traditional payment authorization methods—is that the signature is tied to a document’s content, so, even if it’s hijacked fraudsters cannot steal funds from an account.

PayConfirm is embedded in a bank’s mobile application or operates as a stand-alone application on a user’s smartphone. Regardless of the use-case, the customer can verify the correctness of transaction details or document content and then generate a signature with a single screen tap.

Implementation technologies

The PayConfirm platform includes several functional modules: mobile transaction authentication signature, conflict analysis, PUSH notifications, customer biometric authentication, and early fraud prevention.

The implementation scope is based on the needs of the specific bank and its customers.

Airome is willing to share its success stories; provide a full set of project and technical documentation; help you formalize your business requirements; help choose the best option for embedding, deploying, and operating the PayConfirm platform.

Results

Signing transactions and documents on a smartphone using the PayConfirm platform:

- provides the highest possible protection for legal entity transactions;

- ensures compliance with legislation and regulatory bodies;

- reduces bank expenses on the digital channel;

- enhances customer user experience;

- enables implementation of new digital services for customers;

- helps a bank achieve higher ratings concerning the quality of digital banking services for legal entities.